doctorhousingbubble.com /

The last decade has added 10 million renter households. This has happened at the same time that the homeownership rate has fallen to a generational low. Since builders realize that broke Millennials are not going to save the housing market certain markets went into housing mania 2.0. Many people are unable to buy given prices and in many markets home prices are above their pre-market bubble peaks. So with investors and foreigners crowding out the market, we are now left with the current predicament. High home prices and high rents. Rents in many markets seem to be softening. This might be a summer lull or a slight turning point. It is amazing to hear people talk about “stability” but look at this election year! Would you call this predictable? So let us take a look at some rental data.

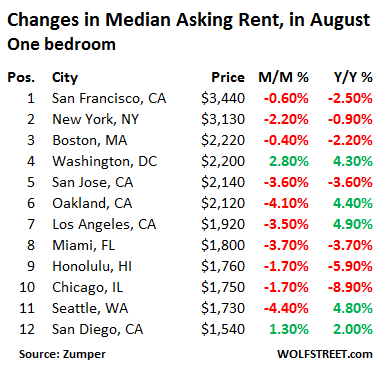

Rents soften in many markets

Rents are paid with after tax income. What they don’t tell naïve future landlords about rents is that sure, rents are stickier on the way down but vacancies can eat deep into profits. And normally when business cycles turn, people realize how weak or strong their cash reserves are.

So I saw this report highlighting rents from Zumber looking at 1 million active listings:

The post Rent prices drop in 10 of top 12 US Markets: Rental Armageddon taking a brief break for the election. appeared first on Silver For The People.